A Message from the Executive Director in Charge of Finance

Optimizing Our Business Portfolio via Selection and Concentration to Return to a Growth Track

Naoki OkawaDirector and Senior Executive Officer

Starting from Lessons Learned in the Course of Past Midterm Plans

The formulation of our latest Midterm Plan started with reflecting on lessons learned over the course of the two preceding midterm plans, which saw many targets remaining unmet. Although the aim of both of these plans was to secure stable profit growth, actual operating results included year-on-year declines of 30% to 40% in profit due in part to fallout from the COVID-19 pandemic.

The root cause of these shortfalls was the handling of our businesses following the dissolution of our alliance with Goodyear Tire & Rubber Company (Goodyear) in October 2015. Specifically, because of the state of the business environment at the time of the dissolution of this alliance and relevant joint ventures, the Sumitomo Rubber Group has still not been able to expand into the global market in the mainstay Tire Business. After entering into the alliance agreement with Goodyear in 1999, we went on to pursue growth in China, emerging countries and elsewhere overseas with an eye to developing a solid earnings framework. To this end, we endeavored to develop a network of overseas production bases, in 2013 acquiring a factory in South Africa and launching our Brazil Factory and in 2015 opening our Turkey Factory.

Amid these endeavors, we acquired rights to use the Dunlop brand as a result of the dissolution of the abovementioned alliance. The acquired rights encompassed 33 countries and enabled us to sell products under this brand to Japanese automakers in North America, as well as customers in Japan, Russia, the Middle East and Africa. Drawing on these rights, we have striven to further expand our production capacity. We have also maintained and stepped up a business approach centered on pursuing cost reductions via higher utilization rates at production facilities and raising sales revenue to secure profit. However, instead of focusing on our fields of strength, we began overemphasizing keeping factory utilization rates high to meet rising orders. This had a negative effect on profitability. Then, the COVID-19 pandemic struck.

Our sales have stagnated ever since in China, which had otherwise been an important source of revenue, due to the enforcement of the “zero-COVID” policy. Moreover, maritime transportation fees associated with exports from Japan, Thailand and Indonesia to North America surged and have remained high, at seven to eight times the pre-pandemic levels, for some time. This has put us in the odd situation of the more we export the higher the losses we record. Taking this into account, we can now clearly conclude that a business approach overly reliant on maximizing production capacity is demonstrably problematic.

Under the new Midterm Plan, we shifted our focus away from prioritizing sales and toward other means of achieving profitability. In line with this shift, we are pursuing the timely and optimal allocation of human resources, materials and funds to enhance our earnings power. In this way, we will transform Sumitomo Rubber Industries so that we will once again reclaim our standing as a company known for innovation and profitability. For example, we have set a target of improving the product mix by reducing the number of tire models in production by approximately 30%. So far, we have decreased this number by around 17%. We will allocate the surplus cash arising from these efforts to businesses with high growth potential.

Maintaining a Priority on North America in the Tire Business while Reconsidering the Positioning of the U.S. Factory from the Ground Up

Maintaining our market foothold in North America involves both managing local businesses and running local factories.

Of course, we consider our tire business in North America an important operation and our priorities for this business are unflagging. On the other hand, our North American product supply involves two supply channels: (1) exports from Japan, Thailand and Indonesia and (2) production at local factories.

Declines in business profit from the North American tire business can be attributed primarily to the surging maritime transportation fees mentioned earlier. Prior to the COVID-19 pandemic, we had been able to secure sufficient profitability in the United States by marketing tires exported from Japan, Thailand and Indonesia. However, that situation has changed radically. Although maritime transportation fees have begun to stabilize somewhat and thus allowed us to secure profit from exports, we now have no choice but to expand local production volumes if we are to circumvent the risk of once more being confronted by such circumstances.

Second, due to travel restrictions enforced upon the breakout of the COVID-19 pandemic, we have become unable to dispatch staff reinforcements to the USA Factory. This hindered us from implementing planned productivity enhancements.

Our strategy had been to offset losses recorded by the USA Factory with earnings from exports to keep our North American operations on a profitable track. While doing so, we had aimed to thoroughly upgrade production lines in place at this factory. However, this strategy did not progress as expected. To rectify this situation, we recently began dispatching specialists from international business- and manufacturing-related divisions in Japan to the USA Factory, as the COVID-19 pandemic has largely been subdued. These individuals are currently undertaking a fresh review of production issues at this factory to help it minimize losses.

In addition, although we may eventually establish a new factory in North America to increase the local production volume, our sole focus at the moment is improving the profitability of local operations by 2025. We will then review the positioning of our existing USA Factory based on prevailing conditions and will for the present refrain from ruling out any options so as to make the best decision.

Promoting ROIC Management as We Shift Our Resources to Businesses with High Growth Potential and Profitability

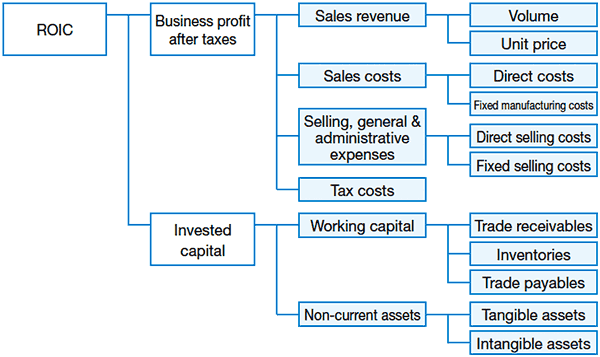

Looking ahead, we will work to optimize our business portfolio via selection and concentration while raising cash from businesses undergoing structural reforms, with the aim of shifting investment and human resources to businesses with high growth potential and profitability. To measure the success of these endeavors, we have identified Return on Invested Capital (ROIC) as an indicator.

Invested capital, the denominator of the ROIC formula, is significantly affected by changes in capital expenditure and working capital. Our Working Capital Task Force was launched as part of the “Be the Change” Project, which aims to reinforce the foundations of our business, and has succeeded in achieving its target of raising cash flows amounting to ¥30.0 billion by December 31, 2022, via the reduction of working capital. These ongoing efforts will be taken over and promoted by the Finance Department, which was newly established in January 2023.

As for internal infrastructure, preparatory measures are now under way to incorporate ROIC data into our in-house developed Enterprise Resources Planning (ERP) system. We plan to design an ROIC management framework that will connect this indicator to individual target management. We will strive to disseminate ROIC management by helping employees thoroughly understand the significance working capital control in terms of improving ROIC and by sharing outcomes of ROIC management with them.

ROIC Tree

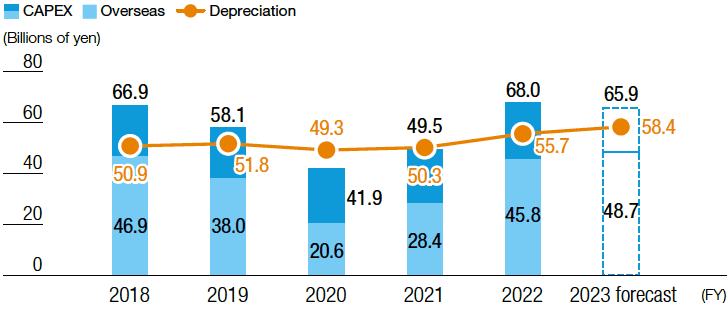

CAPEX and Depreciation

*IFRS 16 (Lease) impact has not been included since 2019.

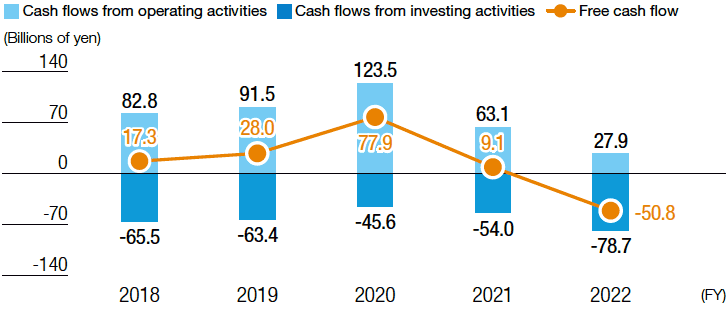

Cash Flows

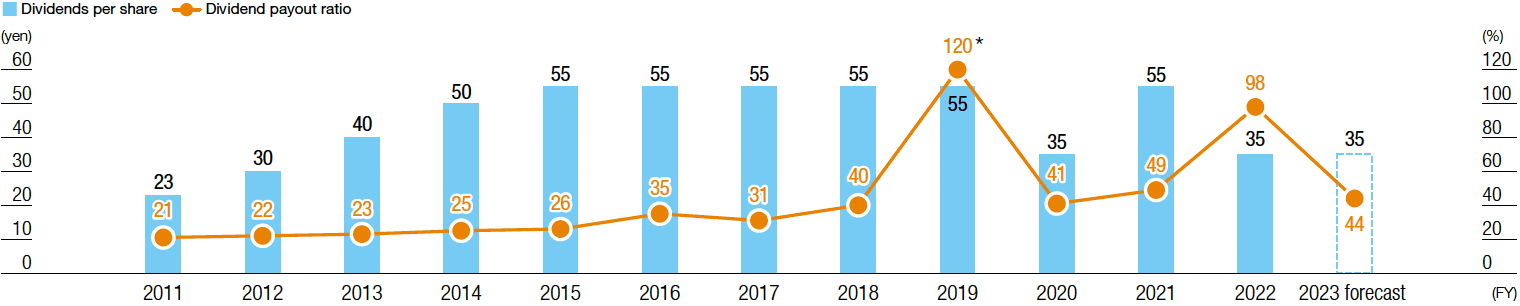

Policy on Returns to Shareholders

The Sumitomo Rubber Group aims to constantly improve its business and thereby maximize the volume of positive cash flows from operations in order to raise its stock price. We believe that such improvement is the most important form of returns to shareholders.

To this end, we allocate cash inflows from these endeavors to capital expenditures and R&D. Also, we intend to maintain a robust and stable stream of cash dividends over the long term while comprehensively reviewing our situation with respect to retained earnings, etc. At present, we have no plan to repurchase treasury stock for the purpose of shareholder returns.

In addition, although this is not necessarily a commitment set in stone, we do tell investors at our regular financial announcements that we are aiming for a dividend payout ratio of at least 40%. Our group has always endeavored to uphold high standards when it comes to paying out steady dividends over the long term, and we have no intention of changing our thinking on investor returns in the future.

Dividends per Share

*The exclusion of extraordinary impairment loss would result in dividend payout ratio of 48% for 2019.

Final Words

Under the current Midterm Plan, I will join all Sumitomo Rubber Group employees in assiduously working toward enabling our group to reclaim a sound financial base and secure growth. Furthermore, I will decisively execute measures designed to blaze a pathway toward overall optimization. With regard to progress under the Midterm Plan, we will provide biannual opportunities for our stakeholders to receive status updates, with President Yamamoto serving as a presenter.