The Basic Management Policy of the Company is that we shall continuously strive to enhance both our economic value and our value to society while making ongoing, active contributions to the development of a sustainable society, with Our Philosophy serving as the basis for our every decision and as the impetus for our every action. In keeping with this policy, the Company considers the enhancement of overall corporate governance to be a key management objective.

(as of March 28, 2025)

The Company’s Board of Directors has been conducting analysis and evaluation of the Board of Directors’ performance as we have done in the past.In 2024, for the first time in three years, a third-party organization conducted a questionnaire and interviews as part of the evaluation of the effectiveness of the Board of Directors, which had been conducted in the past, and the results showed that the majority of respondents generally agreed that the Board of Directors is functioning effectively. In the interviews, many respondents said that the effectiveness of the Board of Directors has increased due to improvement measures taken previously in the operation of the Board of Directors, and that free and open discussions and exchanges of opinions are possible under the appropriate and fair management of meetings by the Chairperson of the Board of Directors, who is an Outside Director. On the other hand, it became clear that there are still issues to be addressed with regard to the delegation of authority to individual Directors and subordinate meeting bodies, and follow-up on the progress of matters resolved by the Board of Directors in the past.

In the future, the Company will work to improve the effectiveness of the Board of Directors and further increase corporate value by taking various measures, such as reviewing the criteria for the agenda of the Board of Directors, so that sufficient time can be secured for matters that require lengthy discussions.

The basic policy for the remuneration of our Directors and Executive Officers is to adopt a remuneration system that is linked to shareholder interests, ensuring it functions effectively as an incentive to sustainably enhance corporate value. When determining the remuneration for individual officers, we ensure it is set at an appropriate level based on their respective responsibilities.

Specifically, the remuneration for Directors (excluding Outside Directors) and Executive Officers consists of a basic salary as fixed remuneration and bonuses as performance-based remuneration. Additionally, Directors (excluding Outside Directors) are granted stock-based remuneration as a medium- to long-term incentive. For Outside Directors, who have supervisory functions, only a basic salary is provided to ensure their professional independence.

The remuneration for Directors and Executive Officers is determined by the Board of Directors based on recommendations from the Nomination and Compensation Committee, which objectively and fairly reviews the proposals. The committee is composed of a majority of independent outside directors.

Furthermore, the remuneration for Audit & Supervisory Board Members is determined and paid within the remuneration framework approved by the General Meeting of Shareholders, based on discussions among the Audit & Supervisory Board Members.

Medium- to long-term incentive compensation is designed to provide incentives for the sustainable enhancement of corporate value and to further align the interests of directors with those of shareholders. To achieve this, the company allocates shares with transfer restrictions to directors until they resign for reasons deemed legitimate by the Board of Directors. The number of shares allocated is determined based on a comprehensive consideration of factors such as the director's position, levels at other companies, and employee salary levels, according to a stock compensation table. The medium- to long-term period is generally considered to be three years or more.

| Type | Number of Persons paid | Amount paid |

|---|---|---|

| Director | 13 | ¥461 million |

| Audit & Supervisory Board Member | 6 | ¥88 million |

Notes.

1. In accordance with a resolution at the 133rd Ordinary General Meeting of Shareholders held on March 27, 2025, the maximum total amount of remuneration for Directors and Audit & Supervisory Board Members was set at ¥800 million per year (of which ¥100 million per year is for Outside Directors) and ¥150 million per year, respectively. In addition, at the time of the above resolution, the Board of Directors consisted of ten Directors (including five Outside Directors), while the Audit & Supervisory Board consisted of five Members (including three Outside Audit & Supervisory Board Members). Subsequently, the limit on the total amount of stock-based remuneration to be granted to Directors (excluding Outside Directors) separately from the above-mentioned remuneration, has been set based on a resolution by the 130th Ordinary General Meeting of Shareholders held on March 24, 2022, to furnish incentives to the recipients in the form of the Company’s shares with transfer restrictions. Based on this resolution, the limits on such remuneration have been set at ¥40 million and 20,000 shares, respectively, in terms of the value and number of shares that can be granted annually. At the time of said resolution, the Board of Directors consisted of seven Directors (excluding Outside Directors).

2. The number of persons paid above includes one Director and one Audit & Supervisory Board Member who resigned as of March 28, 2024.

From 2023, we have started to reflect the degree of achievement of sustainability goals, including climate change, in the compensation of Directors and Executive Officers.

The Nomination and Compensation Committee will also determine the status of achievement of sustainability targets, including climate change, for directors and executive officers, which will be reflected in their compensation.

To realize “Our Philosophy,” the Group’s corporate philosophy structure, resolve materiality issues over the medium to long term through promotion of ESG management, and execute the Mid-Term Plan, the Company has established, as a skills matrix, the expertise that Directors and Audit & Supervisory Board Members should possess in order for the Board of Directors to properly carry out its decision-making and management supervisory functions.

The content of each item is determined by the Board of Directors after discussion by the Nomination and Remuneration Committee, taking into consideration the business environment and the Company’s management plan and business characteristics, and includes up to four items of expertise that are expected primarily from each person.

Reasons for Adoption of Items in the Skill Matrix

| Name | Position | Skill Matrix for Directors and Audit & Supervisory Board Members | ||||||

|---|---|---|---|---|---|---|---|---|

| Corporate Management and Business Strategy | Production and Technology | International Business | Sales and Marketing | Legal and Governance | Financial Strategy and Accounting | DX and IT | ||

| Satoru Yamamoto | Representative Director,President and CEO (President) | ● | ● | ● | ||||

| Hidekazu Nishiguchi | Representative Director (Managing Executive Officer) | ● | ● | ● | ● | |||

| Naoki Okawa | Director (Senior Executive Officer) | ● | ● | |||||

| Yasuaki Kuniyasu | Director (Senior Executive Officer) | ● | ● | ● | ||||

| Hideaki Kawamatsu | Director (Senior Executive Officer) | ● | ● | ● | ● | |||

| Mari Sonoda | Outside Director | ● | ● | ● | ||||

| Takashi Tanisho | Outside Director | ● | ● | ● | ● | |||

| Misao Fudaba | Outside Director | ● | ● | ● | ||||

| Naomi Motojima | Outside Director | ● | ● | |||||

| Yoshihisa Ueda | Outside Director | ● | ● | |||||

| Kazuo Kinameri | Standing Audit & Supervisory Board Member | ● | ● | ● | ● | |||

| Hiroki Ishida | Standing Audit & Supervisory Board Member | ● | ● | ● | ● | |||

| Asli M. Colpan | Outside Audit & Supervisory Board Member | ● | ● | ● | ||||

| Hirofumi Yasuhara | Outside Audit & Supervisory Board Member | ● | ● | ● | ||||

| Toshikazu Tagawa | Outside Audit & Supervisory Board Member | ● | ● | ● | ||||

The Group is focusing on training next-generation managers and overseas base managers.

A Management School was established so that candidates can acquire skills related to perspective (viewing things as a manager), knowledge (basic knowledge required of management), and thinking (critical thinking). Starting in 2003, approximately 20 people have been selected each year, and classes are offered throughout the year. Management attends the last meeting, and reports on issues such as future business expansion are provided. This is the training of next-generation managers.

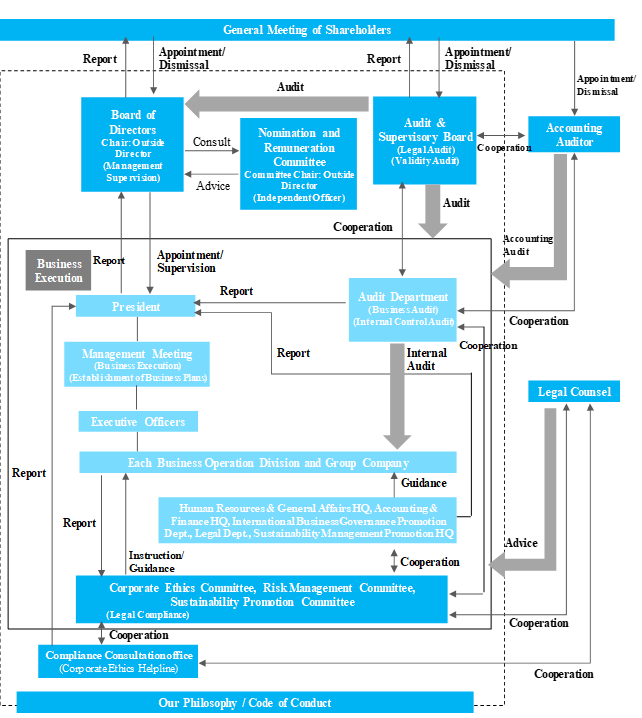

Based on “compliance with social norms,” which is stipulated in the Company’s “Corporate Code of Conduct,” Sumitomo Rubber Industries maintains the guideline that “corporate activities must adhere to laws and ordinances, social norms and standards of public decency.” Moreover, the Company has established “systems to ensure that in the execution of their duties, Directors comply with laws and the Company’s Articles of Incorporation and that Group operations undertaken by the Company and its subsidiaries are always appropriate,” thereby securing strict legal compliance. In addition to complying with laws and its Articles of Incorporation, Sumitomo Rubber Industries aims to fulfill its corporate social responsibilities and, to this end, has established a strict code of corporate ethics while pursuing sound business operations. To that end, the Company formulated “Regulations on Corporate Ethics Activities” in February 2003. Simultaneously and in line with these regulations, the Company established the “Corporate Ethics Committee,” which meets on a quarterly basis and is chaired by the President, with the aim of strengthening its Group-wide compliance system.

Furthermore, Sumitomo Rubber Industries set up a “Corporate Ethics Helpline (Compliance Consultation office)” directly controlled by the President as a corporate ethics helpline for employees. This enables the Corporate Ethics Committee to investigate any problems that arise within the Group and give sufficient attention to ensuring that those employees who come forward are not penalized. With a close eye on legal issues, the Company also takes such measures as seeking advice from corporate attorneys as circumstances demand.

As a global enterprise that is dedicated to observing and respecting all applicable laws and regulations, engaging in fair and transparent business activities, contributing extensively to our communities and society and earning the trust and respect of our stakeholders, the Sumitomo Rubber Group (hereinafter, “our Group”) has made it our basic management policy to continue producing new value for more pleasant and attractive lifestyles for our customers while continually enhancing our corporate value for our stakeholders. One aspect of this basic management policy is our Group’s dedication to fulfilling our tax obligations in an appropriate and ethical manner so that we may contribute to the development of the local and regional communities in which we operate.

By a resolution of our Board of Directors, our Group has established and fully implemented the necessary framework to ensure the proper execution of business of our Group. Management risks that may adversely and materially affect the business activities of the Group shall be addressed by the relevant division and/or subsidiary in advance through analysis of those risks and the planning of countermeasures in accordance with company regulations concerning risk control, which stipulate risk management rules for the entire Group. Further, we have also established and implemented a system of checks to ensure that our business activities are fair and honest while striving to minimize our Group’s tax risks. If necessary, advice and guidance may be sought from professionals, including our tax advisors, in analyzing and planning countermeasures against such risks.

Our Group engages in tax planning activities that appropriately reflect economic entities and are in full accordance with OECD Guidelines as well as the relevant laws and regulations of the various countries in which we operate. Further, our Group has pledged that we will neither exploit tax havens as a means of avoiding taxation nor engage in either business dealings whose primary aim is the reduction of our tax burden.

Our Group considers daily communication with every stakeholder to be an essential aspect of remaining conscious of the responsibilities of our Group. Our Group hopes to build a trust-based relationship with Tax authorities through the appropriate disclosure of all pertinent information in a timely manner and fully intends to enhance the transparency of our operations. We will also file tax returns and pay taxes on time in accordance with all relevant laws and regulations while working with Tax authorities to cooperate with official requests by promptly providing all requested information while.

The Sumitomo Rubber Group (hereinafter referred to as ‘the Group’) believes that it is important to build and maintain relationships of trust with our customers and society based on our corporate philosophy, ‘Our Philosophy.’ This policy has been formulated in accordance with our internal regulations, including the Information Security Policy and IT Security Policy, to protect the Group’s important information assets from various threats and to ensure and maintain information security. We will maintain a safe and secure environment by appropriately controlling the various risks associated with information assets.

Our group maintains a comprehensive information security management system by appointing an Information Security Officer and assigning responsibility for information security to specific departments based on the type of information handled. Each department is responsible for identifying information-related risks, planning and overseeing the implementation of appropriate security measures, and ensuring the effective operation of all security measures.

All employees of our group comply with laws and regulations related to information security and implement measures to ensure confidentiality, integrity, and availability to protect against various threats.

Additionally, we continuously review and update security measures in response to changes in effectiveness and business environments.

We classify our information assets according to their importance to ensure confidentiality, identify their location, and manage them appropriately. We also provide regular training and guidance to employees on information security initiatives and related rules to ensure the daily protection and management of corporate secrets.

In the event of an information security incident or accident, such as information leakage, unintentional information updates, destruction of information assets, system downtime, or business interruption due to the unavailability of information assets, we will promptly take appropriate measures, report the incident to relevant parties, and implement necessary responses.

Our group evaluates security risks at manufacturing sites, taking into account safety, the environment, quality, stable supply, and other factors, and implements security measures appropriately selected based on the characteristics of manufacturing processes and equipment.

Our group incorporates security concepts into the development stage of products and services provided to customers and implements necessary security management even after shipment or service commencement.

We will continuously review and improve this Information Security Basic Policy.

In the event of revisions, we will notify customers through posting on our website or other appropriate methods.