The year 2024 was a very important year for us. In addition to the launch of our new Next-Generation All-Season Tire “SYNCHRO WEATHER” in October, which bring together all of our technologies, we were able to make the decision in November to cease production and close our USA tire factory that had been plagued by structural problems for many years. The latter was especially a significant achievement for the Company. By manufacturing tires that were previously manufactured at our USA factory at other Group plants in Asia, we now have a clear outlook for improving our business profit margins.

In addition, on January 8, 2025, we formally signed a purchase agreement to acquire the DUNLOP trademark rights for four-wheeled tires in Europe, North America, and Oceania region from The Goodyear Tire & Rubber Company of the U.S. After many years of discussions with Goodyear, we were able to purchase the trademark rights at a reasonable price, with an EV/EBITDA multiple of 5.7 times. This marked an important step in our business strategy.

Having steadily moving forward with our management strategies of implementing structural reforms in North America and acquiring the DUNLOP trademark rights, we now have more management options for the future. We aim to achieve growth and development through the management of the DUNLOP brand.

Based on the target to achieve 6% ROIC by 2027 which we set out in our mid-term plan for 2023 and beyond, we identified approximately 10 businesses and product lines that are subject to improvement and have been working on structural reforms for them. We completed our target for six businesses and product lines by the end of 2024 and were able to achieve an increase of ROIC to 6.5% in 2024 (5.7% in 2023←1.7% in 2022). In 2025, we will focus on structural reforms for the remaining four businesses and product lines to further increase ROIC. In our Long-Term Corporate Strategy ““R.I.S.E. 2035”,” announced on March 7, 2025, we set the following financial targets for 2027: business profit margin of 10%, ROE of 10%, D/E ratio of 0.6, and ROIC of 8%. We revised our business profit margin and ROIC targets to higher levels than those set in our previous mid-term plan.

Going forward, in order to improve ROIC, we will further subdivide our existing three businesses (Tire, Sports, and Industrial Products) and implement “ROIC management by business.” Starting in 2025, we will shift to more aggressive management while firmly maintaining our control of ROIC. However, in our management, we will avoid pursuing volume, and instead focus on profitability.

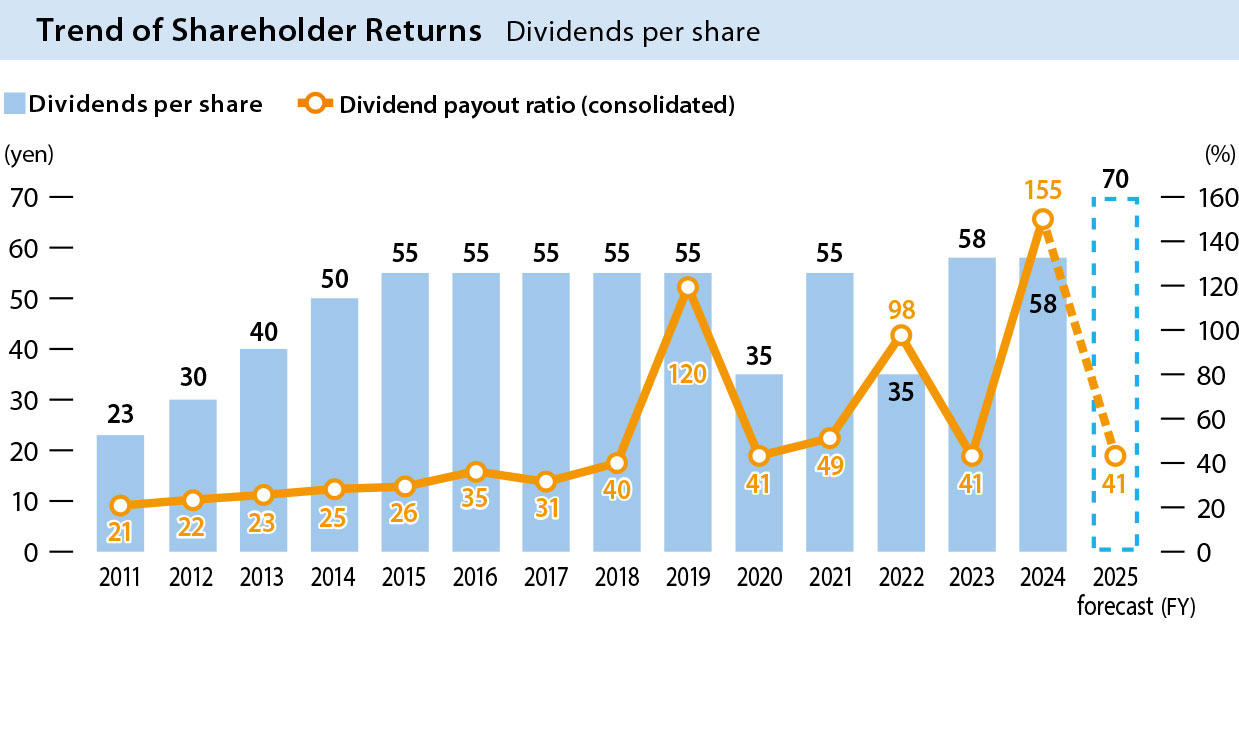

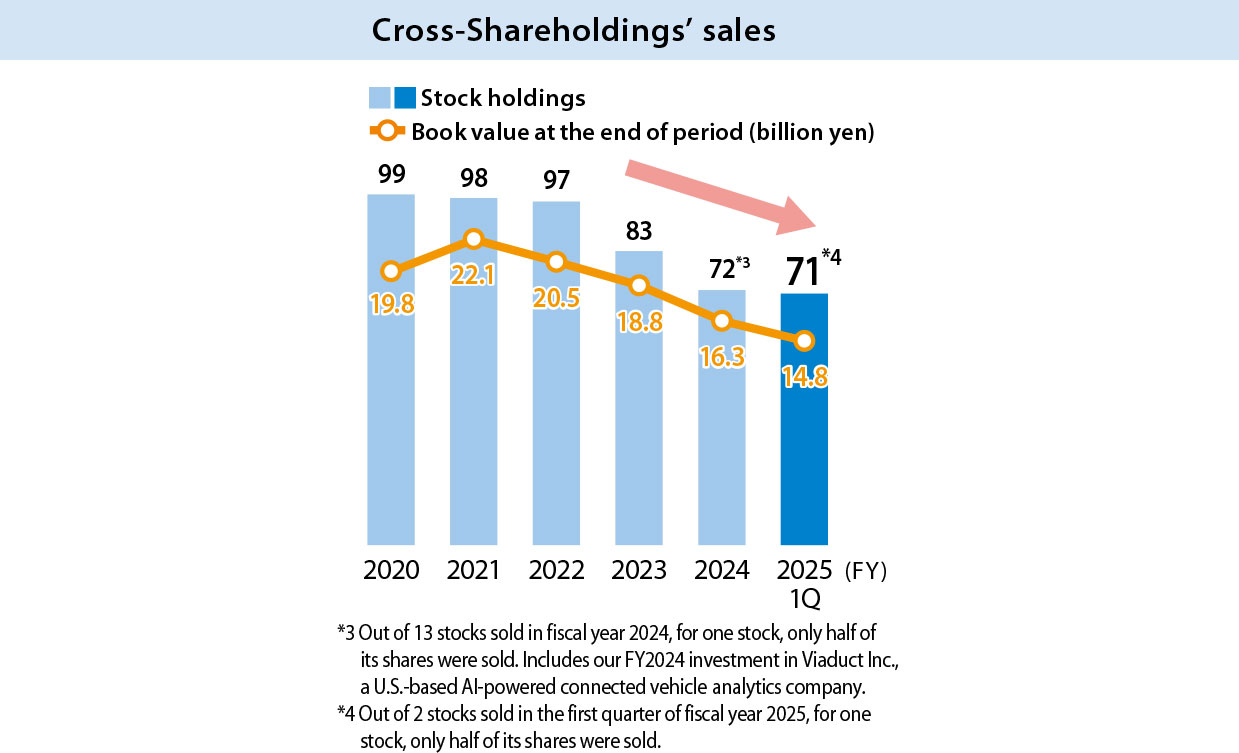

In our Long-Term Corporate Strategy ““R.I.S.E. 2035”,” we clearly defined our capital allocation policy and standard for shareholder returns. We will complete structural reforms within 2025, and plan to increase the premium tire ratio to 50% of the entire tire business by 2027. We will utilize the expanded cash flow from structural reforms and premiumization of tires for strategic investment expansion and stable shareholder returns. Our investment for the three-year period from 2025 to 2027 will be at the 500 billion yen level, of which 180 billion yen will be for general investment, 250 billion yen will be for strategic investment mainly for improving brand value and premiumization of tires, and 70 billion yen will be for returns to shareholders.

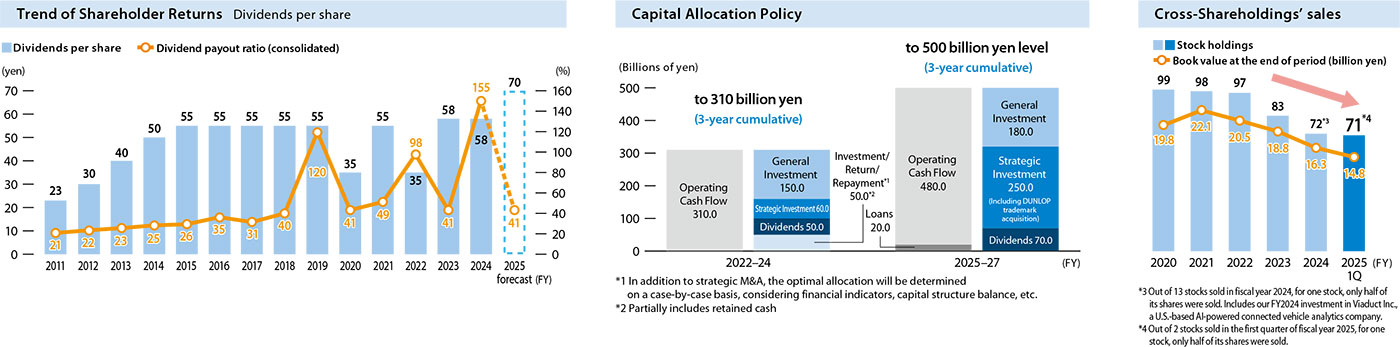

For shareholder returns, our policy is to pay stable dividends with a consolidated dividend payout ratio level of over 40%. In order to ensure stable dividends even if we undertake new structural reforms in the future, we will set the standard as “DOE of 3% or above and consolidated dividend payout ratio of 40% or above from 2026 onwards.” We will also flexibly consider measures such as further increasing the DOE level according to future business performance.

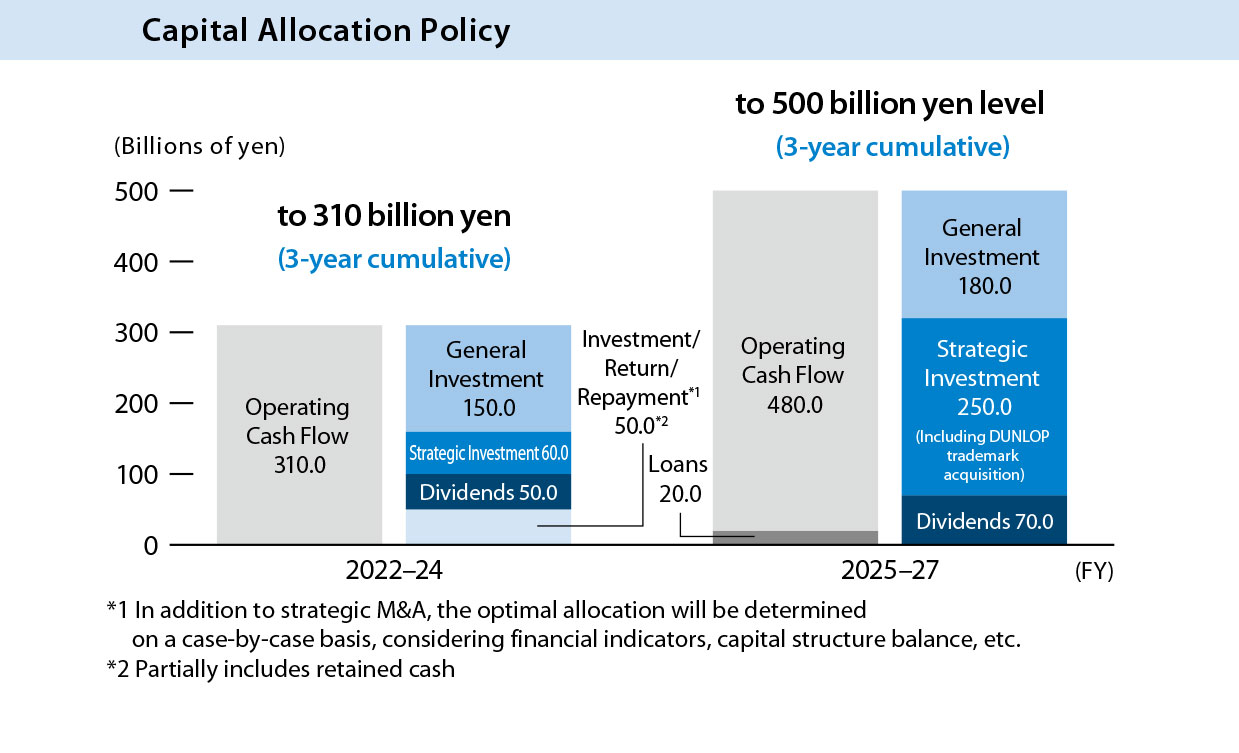

Furthermore, we are actively selling our cross-shareholdings. We sold stocks of 14 companies in 2023, 13 in 2024, and 2 in the first quarter of 2025, which reduced the proportion of cross-shareholdings in total assets to 1.1% (1.2% in 2024←1.5% in 2023←1.7% in 2022. This has allowed us to increase free cash flow.

We appreciate your continued support and cooperation.