In order to achieve “Our Philosophy” (a corporate philosophy framework), Sumitomo Rubber Industries, Ltd. and Sumitomo Rubber group companies (hereinafter “We”, “The Sumitomo Rubber Group” or “The Group”) is identifying its materiality based on the risks and opportunities found throughout our value chain. Among the materiality we have identified, “climate change,” “biodiversity,” and “circular economies” are deeply interconnected, which is why a comprehensive approach instead of isolated measures will be important to work on initiatives.The Sumitomo Rubber Group announced its endorsement of the Taskforce on Climate-related Financial Disclosure (TCFD) in June 2021. In addition, we have committed to disclosing information based on the TNFD Recommendations issued by the Taskforce on Nature-related Financial Disclosures (TNFD) in September 2023 and registered as a TNFD Adopter in January 2024. We were announced as an Early Adopter at the World Economic Forum Annual Meeting in Davos, Switzerland, in January 2024. We analyzed our climate and nature-related dependencies and the impacts of our operations on nature in accordance with the TCFD and TNFD Recommendations and are committed to the proactive disclosure of climate and nature-related risks and opportunities in our operations.

In December 2020, the Sumitomo Rubber Group established “Our Philosophy,” a new corporate philosophy framework that will serve as a major driving force to propel us forward with ever greater speed toward the accomplishment of our groupwide business strategy while also placing particular emphasis on engaging in sustainable business activities that promote harmonious coexistence with society and the natural environment. Our Philosophy defines our Purpose (i.e. the very reason for our existence) as:: “Through innovation we will create a future of joy and well-being for all.” With this Purpose serving as the basis behind our every decision and as the impetus behind our every action, the Sumitomo Rubber Group will continue working to enhance not only our economic value, but also our value to society so that we may contribute to the development of a more sustainable society.

The Group's Sustainability Management Promotion Division plays a central role in promoting climate change and biodiversity initiatives in an integrated manner in cooperation with top management and other departments. In promoting sustainability management, the Sustainability Promotion Committee, chaired by the director in charge of sustainability and including the directors in charge of each division, meets twice a year to ensure the thorough implementation of company-wide policies and to confirm progress on important issues. In addition, the committee’s reports and deliberations are reported to the Board of Directors, which oversees sustainability issues, including those related to climate change and nature.

The director in charge of sustainability, serving as the committee chair, is also responsible for nature-related issues including climate change and biodiversity. The president participates in discussions and deliberations at meetings of the Sustainability Promotion Committee, and those approved in the deliberations are set out in the entire Group's Policy.

For themes that require cross-divisional collaboration, subcommittees have been established as working groups under the Sustainability Promotion Committee. The Carbon Neutral Subcommittee leads efforts related to climate change and the Biodiversity Subcommittee leads efforts related to biodiversity and nature. Each subcommittee consists of a lead management division and participating member divisions. Their responsibilities include planning activities, setting goals, approving action plans, managing progress, and reporting to the Sustainability Promotion Committee and management team.

Through monitoring and reviews by the management team at committee meetings, we continuously enhance our sustainability initiatives and aim to contribute to the realization of a sustainable society by establishing a robust management foundation that supports sustainable growth. In addition, as a mechanism to support the achievement of non-financial goals, the Sumitomo Rubber Group has introduced a system that ties the remuneration of officers to their contribution to sustainable management.

In step with advances in the mobility industry around the world, tire demand is expected to grow. Accordingly, demand for natural rubber, the primary raw material for tires, is likely to grow even stronger. This prospect has prompted looming concerns about the impacts on ecosystems and biodiversity, such as deforestation, and the emergence of human rights and labor rights issues in regions where natural rubber is produced. In addition, it has also been pointed out that human rights risks may result from deteriorating working conditions and disasters that accompany climate change.

As a tire manufacturer, the Sumitomo Rubber Group aims to curb these problems, and to this end, has implemented a variety of initiatives to help the entire supply chain improve and update itself into a more sustainable industry, with a particular focus on the vulnerable natural rubber supply chain.

The Sumitomo Rubber Group formulated its Human Rights Policy in December 2023. This policy was established in consultation with the Board of Directors based on the Universal Declaration of Human Rights, the OECD Guidelines for Multinational Enterprises, the various treaties of the International Labour Organization, and the Ten Principles of the United Nations Global Compact. This policy tangibly describes the Sumitomo Rubber Group's concepts on respect for human rights and serves as the highest policy governing all other regulations and guidelines enforced within the Group regarding how we ensure respect for human rights. In this policy, the Sumitomo Rubber Group highly values the human rights of every stakeholder and expects our business partners to support this policy, and we also expect that our suppliers understand and comply with this policy.

In August 2021, we updated our Sustainable Natural Rubber (SNR) Policy to reflect a policy framework approved by the Global Platform for Sustainable Natural Rubber (GPSNR), with the aim of gearing up efforts to resolve issues in regions where natural rubber is produced, such as environmental problems caused by deforestation and human rights problems in the working environment. In line with our updated SNR Policy, we will proactively promote collaborative initiatives with companies in our supply chain to realize a society in which natural rubber is procured in a sustainable manner.

Risk Control, which define risk management methods for the entire Sumitomo Rubber Group. Deliberations will then be made at the Group’s management meeting or some similar meeting body.

Risks that cut across Sumitomo Rubber Group will be addressed by the entire Group while individual sections in Sumitomo Rubber Group’s Management Department will work in-tandem with the relevant divisions and subsidiaries based on the respective operations under their control. The Risk Management Committee shall oversee group-wide risk management activities and, on an as necessary basis, investigate and confirm whether the risk management system is functioning effectively. If any material risk affecting the Sumitomo Rubber Group emerges or is expected to emerge, the president shall establish a crisis response headquarters pursuant to the Crisis Management Regulations.

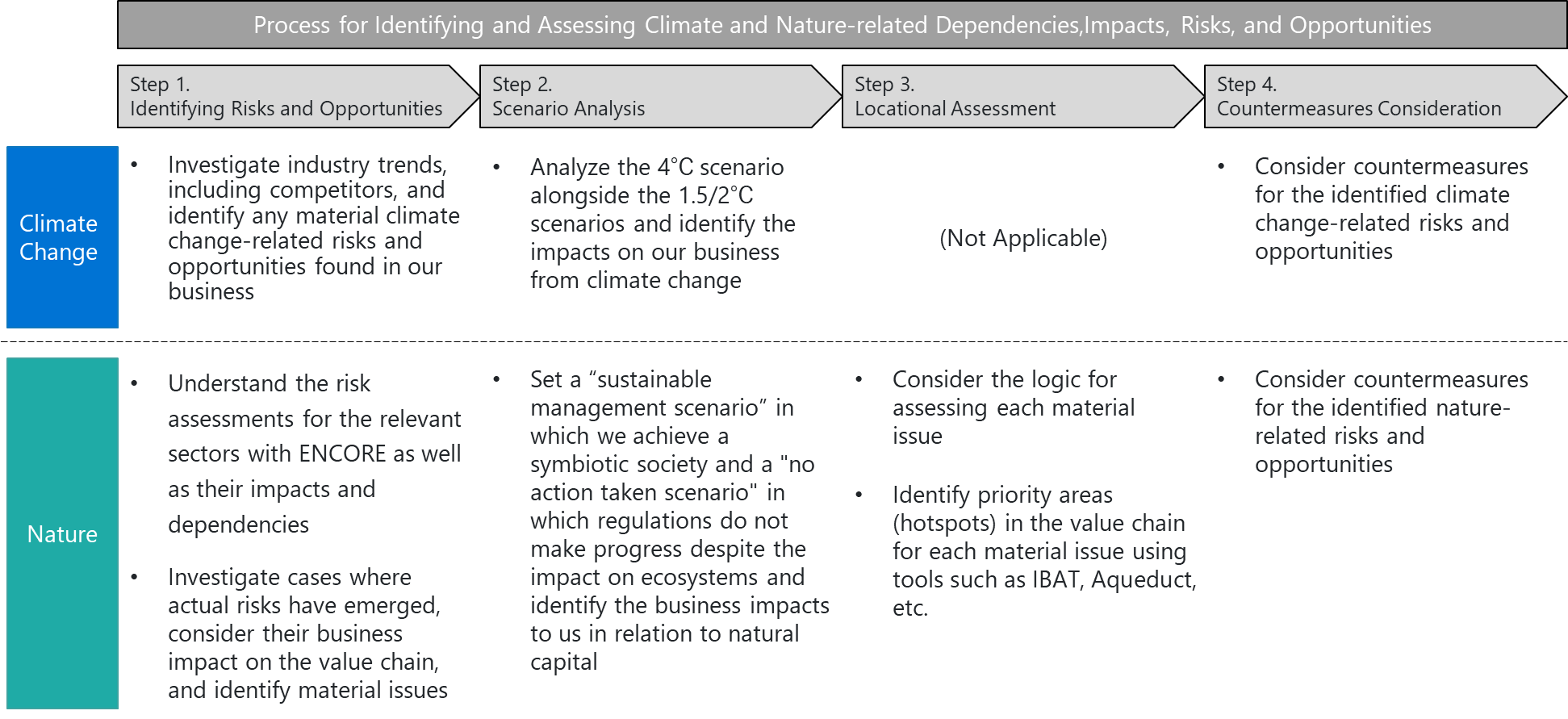

The Sumitomo Rubber Group evaluated its climate and nature-related business risks and opportunities by broadly dividing them across four steps. In Step 1, material risks and opportunities for the Sumitomo Rubber Group related to climate change and nature were identified based on industry trend surveys and risk case studies that included other industry counterparts, analyses that utilized risk assessment tools, and other sets of information. In Step 2, scenarios were developed for both climate change and nature, with it being assessed what impact these scenarios would have on our business. Step 3 identified hotspots that contain nearby ecosystems important to conservation efforts and should be prioritized for future initiatives by conducting locational analyses using public tools such as Integrated Biodiversity Assessment Tool (IBAT) and Aqueduct, targeting only nature-related risks and opportunities. In Step 4, we considered countermeasures for these risks and opportunities.

The president hosts a bi-annual Risk Management Committee in which they serve as the committee chair, overseeing risk management activities and verifying the effectiveness of risk management systems. Various climate change-related managerial risks are analyzed, and countermeasures are considered by the relevant divisions and the Sustainability Promotion Committee, with the Risk Management Committee and the Board of Directors receiving reports and holding discussions on these topics. In addition, we are updating on an annual basis our assessments on the risks that will accompany climate change to account for changes in external environments. This will include, for example, targets based on the Paris Agreement and scientific evidence. Furthermore, nature-related risks are included in the risks assessed and managed by the Risk Management Committee and will be treated as management targets by this committee in the event such risks are assessed to be material risks based on the results of our company-wide risk analysis and survey.

Sumitomo Rubber Group’s Sustainability Promotion Committee is also responsible for promoting environmental activities and managing environment management systems. Decisions made by this committee are reported to the Board of Directors and relevant departments and are then reflected in the Group’s future goal setting and policies. How nature-related risks, which include climate change and biodiversity, are being managed is periodically and continuously reported by the Sustainability Promotion Committee and discussions are held on management techniques when necessary.

With social issues such as the expansion of climate change and loss of biodiversity undergoing dramatic changes, we believe a long-term policy that envisions the year 2050 is essential for the sustainable growth of both society and the Sumitomo Rubber Group. In August 2021, we formulated the “Driving Our Future Challenge 2050” and have been advancing our efforts to accomplish its goals.

As a potential impact on Sumitomo Rubber Group’s business in relation to climate change and natural capital, we expect costs to be incurred in addressing the global regulations and systems for decarbonization and nature positive, which may negatively impact Sumitomo Rubber Group’s financial situation and business results. In addition, the following events may also have an impact on Sumitomo Rubber Group’s business: damage to production equipment due to the occurrence and spread of disasters such as floods accompanying rising temperatures and deterioration of ecosystem services, impact on procuring raw materials, which includes soaring prices due to poor harvests of natural rubber, a primary raw material for Sumitomo Rubber Group, and a reduction in demand for winter tires due to reduced snowfall.

In order to contribute to climate change mitigation and nature positive, Sumitomo Rubber Group’s targets by 2050 are to achieve carbon neutrality in its in-house operations and make total use of sustainable raw materials (biomass raw materials and/or recycled raw materials) and is thus working on a variety of initiatives. We are also implementing a variety of measures as a group for the overall lifecycle of our products, which includes environmentally friendly procurement, logistics, and manufacturing. These measures include promoting the development of environmentally friendly products such as fuel-efficient tires and environmentally friendly services that use sensing technologies to prevent cars from operating with low tire pressure. Sumitomo Rubber Group will also be able to support the expected product demand in the event climate change progresses, which includes increased demand for next-generation tires based on the diffusion of CASE/MaaS and expanded demand for tires designed to reduce environmental impact and fuel-efficient tires. And on top of this, we are continuing to conduct financial assessments on the impact climate change and natural capital will have on our business.

We have organized the potential impact of each risk and opportunity on the tire business in reference to the TCFD and TNFD classifications for nature-related risks and opportunities.

| Risk classification | Business risks for the organization |

Related issues | Potential impact on the organization’s business |

Timeline | Main countermeasures | |

|---|---|---|---|---|---|---|

| Transition risks | Policies/Laws | Introduction & strengthening of regulations for existing products and services | Climate/Nature |

|

Short- medium |

|

| Expansion of CO2 emission reduction requirements | Climate |

|

Medium |

|

||

| Market | Rising raw material prices Changes in consumer behavior | Climate/Nature |

|

Short- medium |

|

|

| Climate |

|

Medium |

|

|||

| Increase in energy costs at manufacturing sites | Climate |

|

Medium |

|

||

| Technology | Development and diffusion of technologies with a low environmental impact and shift from existing products | Climate/Nature |

|

Short-medium |

|

|

| Reputational | Negative feedback from stakeholders due to heightened interest in decarbonization and nature positive | Climate/Nature |

|

Medium-long |

|

|

| Lawsuit | Liability arising from developments in legislation and case law | Climate/Nature |

|

Short-medium |

|

|

| Physical risks | Acute | Frequent and severe natural disasters | Climate/Nature |

|

Short-medium |

|

| Chronic | Unusual weather patterns due to climate change | Climate |

|

Medium |

|

|

| Rising temperatures due to climate change | Climate |

|

Medium |

|

||

*TRWP: Tire and Road Wear Particles

| Opportunity classification | Business opportunities for the organization | Related issues | Potential impact on the organization's business | Timeline | Main countermeasures |

|---|---|---|---|---|---|

| Resource efficiency | Spread of efficiency solutions | Climate/Nature |

|

Medium-long |

|

| Market | Entering climate and nature-related businesses | Climate/Nature |

|

Medium-long |

|

| Products & services | Differentiation through the creation of products and services that contribute to the protection, management, and regeneration of nature and decarbonization | Climate/Nature |

|

Short-Medium |

|

| Reputational capital | Improving the company's reputation with consumers, society, and investors | Climate/Nature |

|

Medium-long |

|

| Energy source | Use of low-emission energy sources | Climate |

|

- |

|

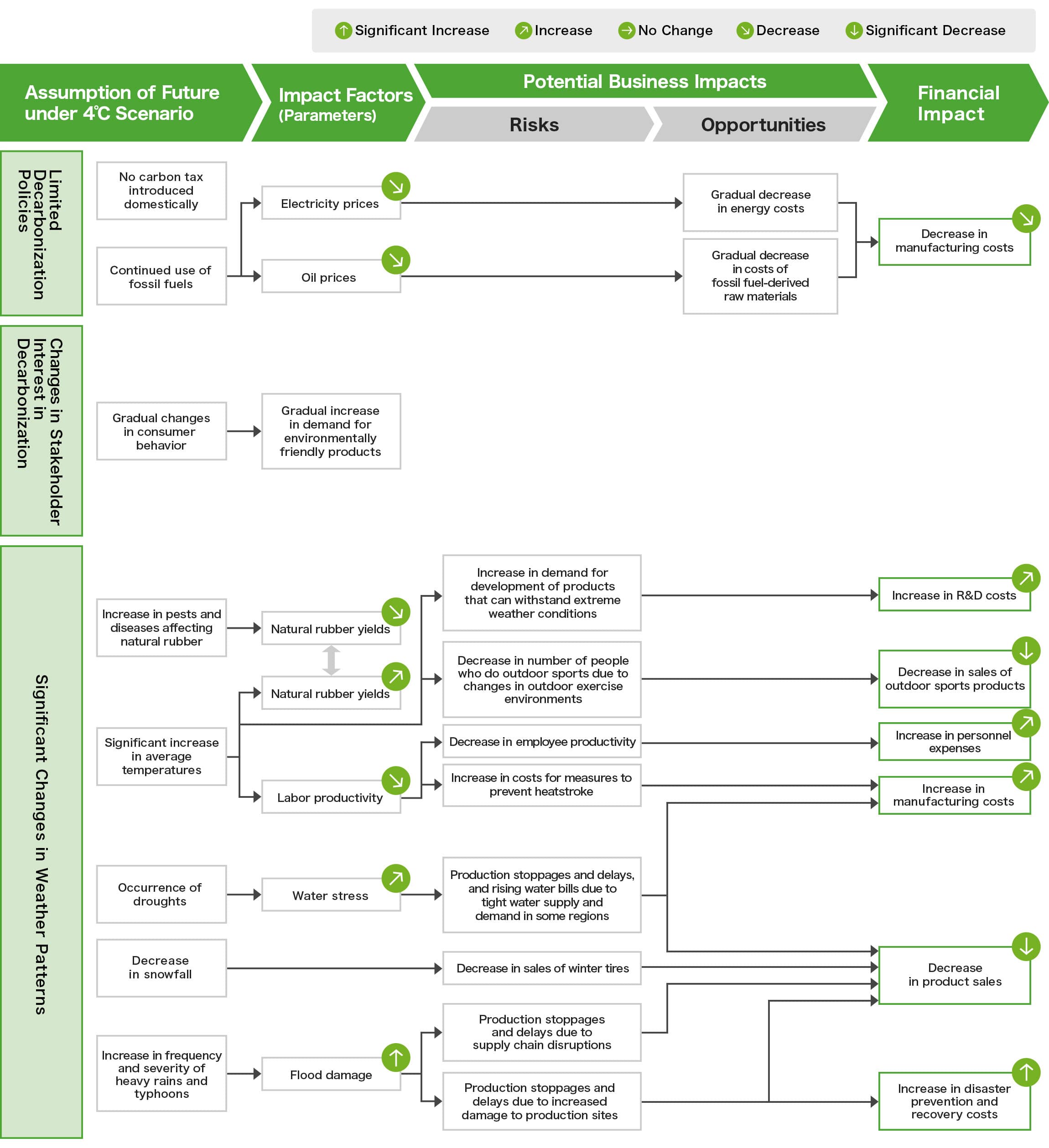

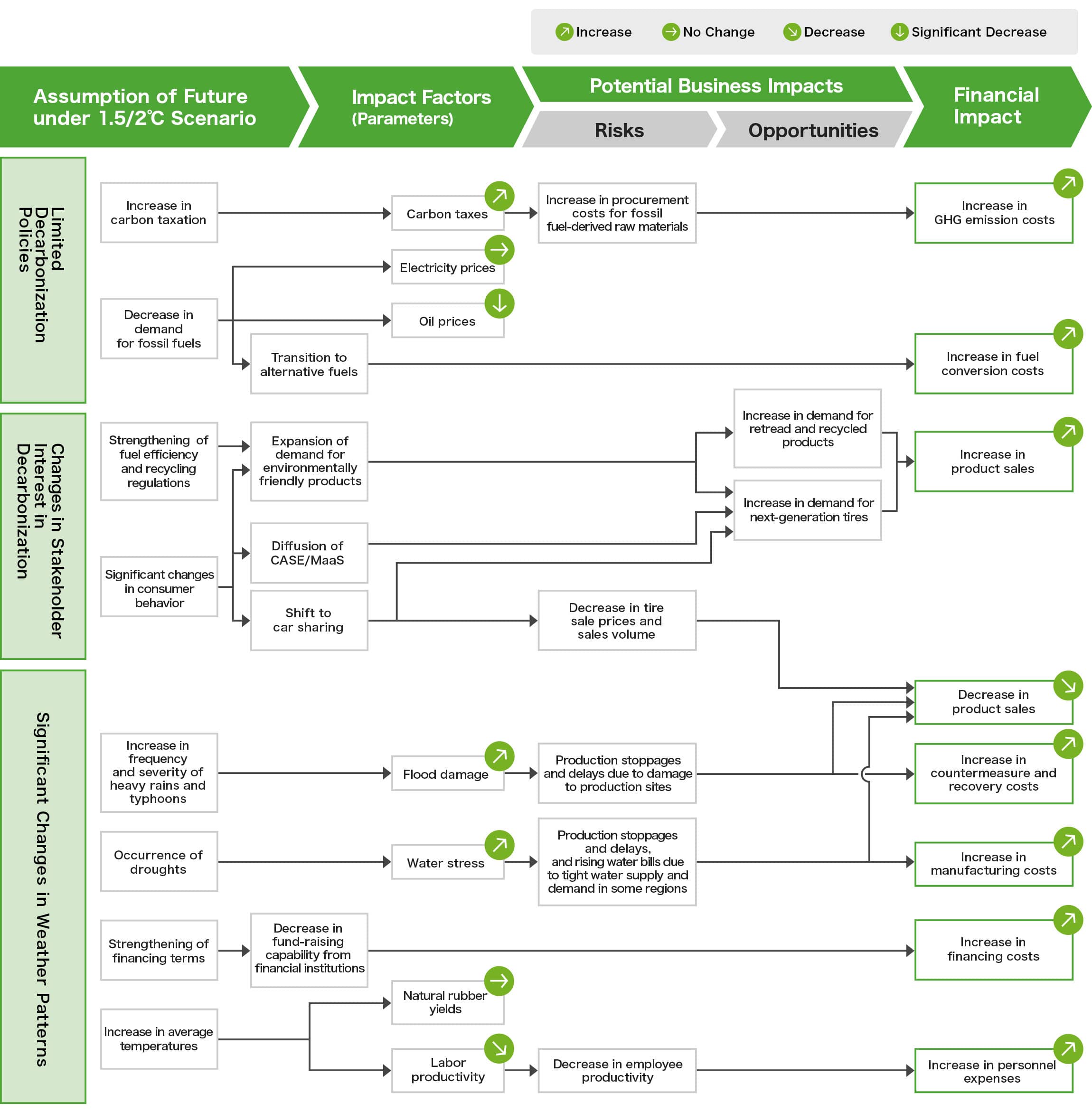

Climate change is one materiality for the Sumitomo Rubber Group, and we are analyzing scenarios to understand the risks in more detail. In 2024, we redeveloped countermeasures for climate-related risks and opportunities after understanding their business impact based on two scenarios: “4°C scenario” and “1.5/2°C scenario.” In addition, we analyzed scenarios for natural capital due to biodiversity being recognized as a materiality. We assessed the business impact of such natural capital by setting two scenarios that target natural rubber, a highly material commodity for Sumitomo Rubber Group: “sustainable management scenario” and “no action taken scenario.”

Although the climate and nature scenarios differ in their maturity and components, the “4°C scenario” and “no action taken scenario,” which have greater physical risks, and “1.5/2°C scenario” and “sustainable management scenario,” which have greater transition risks, share the same fundamental assumptions.

| Scenario | Overview | Main referenced scenario |

|---|---|---|

| 4°C scenario |

|

|

| 1.5/2°C scenario |

|

|

| Scenario | Overview |

|---|---|

| No action taken scenario |

|

| Sustainable management scenario |

|

In the 4°C and no action scenarios, we predict that physical risks will emerge due to society as a whole disregarding nature, with only limited decarbonation/nature positive policies being selected. We also predict that working environments will deteriorate due to rising temperatures in addition to more extreme natural disasters such as heavy rains and floods resulting from the significant rise in average temperatures and large-scale deterioration in ecosystem services. In addition, there are concerns that insufficient water resources will have an impact on production activities due to increased water stress.

Risks such as falling sales accompanying business suspensions, rising countermeasure and recovery costs, and production suspensions due to disruptions to supply chains are predicted as financial impacts to the Sumitomo Rubber Group due to deteriorating green infrastructure and increasingly severe abnormal weather. In addition, there are concerns that the price of natural rubber will rise due to the large-scale deterioration of ecosystem services and significant rise in average temperatures possibly impacting natural rubber yields and working productivity of small farmers and processing plants. The chronic and significant rise in temperatures may also result in increased procurement costs accompanying the shifts in natural rubber yields and production areas, drops in productivity due to deteriorating working environments, and decreased demand for winter tires and outdoor sports products.

Meanwhile, the growing interest in decarbonization and nature positive by stakeholders such as customers, financial institutions, and local communities is expected to slow down, which is why we believe risks related to stakeholder requirements will be minor. However, there is still the risk of being criticized by environmental NGOs for negatively impacting local ecosystems and indigenous peoples, making a loss of reputation or reparations from lawsuits a possibility.

In terms of policy, we do not expect an expansion in nature positive-related laws and regulations, which includes those laws and regulations already being considered for introduction to prevent deforestation, and thus expect that legal and regulatory risks in the “no action taken scenario” will be limited.

In the 1.5/2°C and sustainable management scenarios, which anticipates a world in which social awareness regarding the thought process behind sustainable management has spread and decarbonization and nature positive initiatives have made progress, we predict that transition risks will emerge due to taxation on GHG emissions and regulations such as EUDR continuing to be strengthened. These transition risks will include the need for capital investment, rebuilding of supply chains, increase in R&D costs for alternative raw materials, and increase in energy costs. In contrast, with there being increased consideration towards the environment, we predict demand for environmentally friendly products and services will increase and new business chances for related technologies and solutions will expand.

The introduction of laws and regulations to achieve decarbonization and nature positive, which will include strengthening regulations on existing products and services, expanding demands to reduce GHG emissions, preventing deforestation, and restricting the development of plantations, will expand under these policies. As a result, we predict risks that will include costs being incurred from complying with these laws and regulations, the development and manufacturing of products that comply with these laws and regulations, and a rise in raw material prices due to an increased demand for traceable natural rubber.

In addition, due to increased interest by customers and local communities in decarbonization and nature positive, we believe there is a need to address the significant changes in consumer behavior, which includes an increased demand for environmentally friendly products. Furthermore, we anticipate there will be fierce criticism from environmental NGOs or citizen groups in response to any negative impact on local ecosystems and indigenous peoples, which is why we believe there is an increased risk of a loss of reputation or reparations from lawsuits. And moreover, we anticipate that elements of decarbonization and nature positive will be incorporated into the financing decision criteria of financial institutions, raising concerns that the Group’s ability to procure funds will be degraded.

On the other hand, due to the expectation that changes to ecosystem services and weather patterns will be limited, we believe there will be minimum impact on supply volumes and prices for raw materials such as natural rubber accompanying changes in the natural environment and direct operations due to natural disasters.

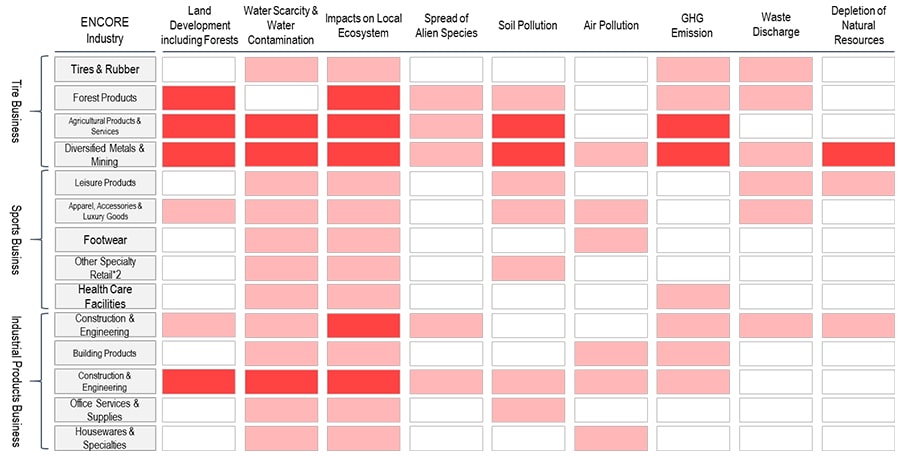

To embark on our TNFD response, we first screened nature-related risks and opportunities in our tire, sports, and industrial products businesses. Using a nature risk assessment tool (ENCORE), we assessed our nature-related dependencies and impacts considered material for each business and created a heat map.

The results of the analysis with ENCORE confirmed that our tire business has a significant dependency and impact on nature. Therefore, in 2023, the first year of our TNFD response, we conducted a risk assessment for our tire business using the LEAP approach, the risk assessment method recommended by the TNFD, followed by a risk assessment for our sports and industrial product businesses in 2024.

In addition to the dependency and impact assessment using ENCORE, we investigated cases of business risks that could have a significant impact on our business to give shape to these material issues. We also evaluated the significance of nature-related risks and opportunities by organizing the relationship between the relevant nature-related issues and our value chain.

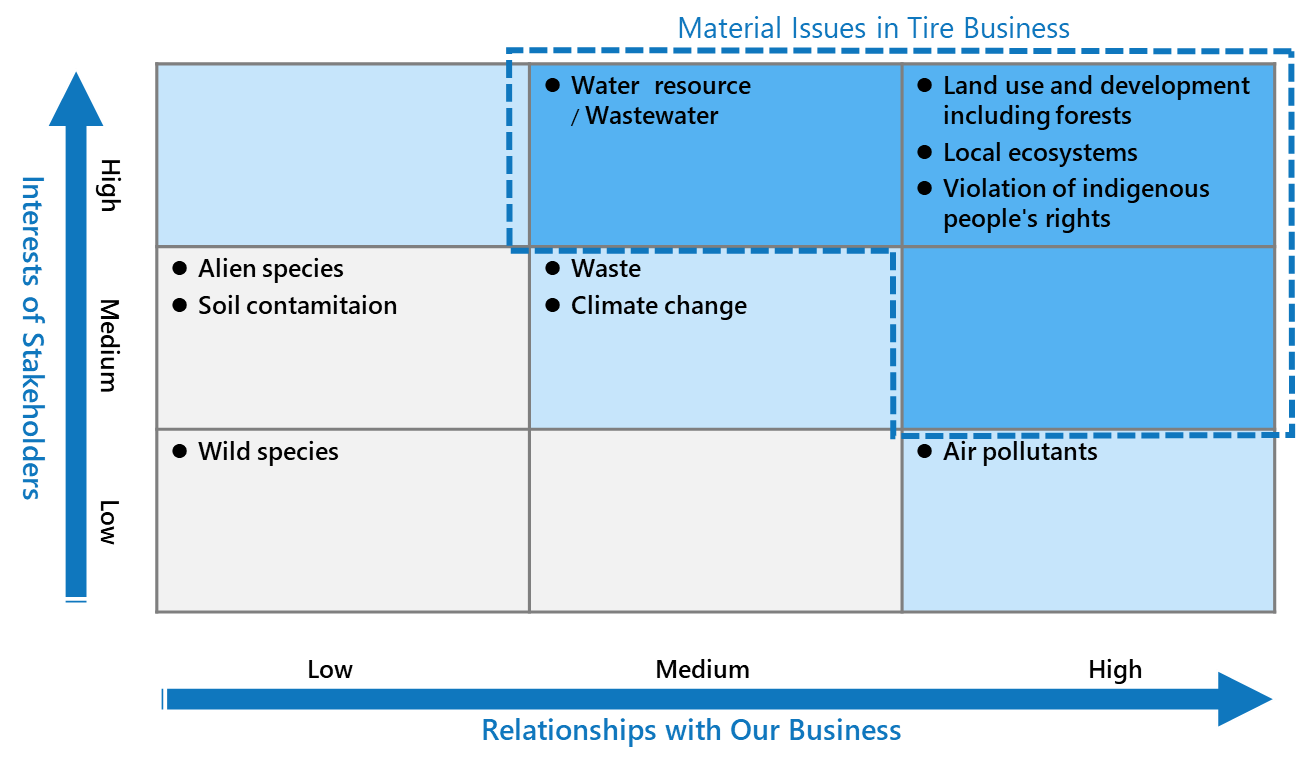

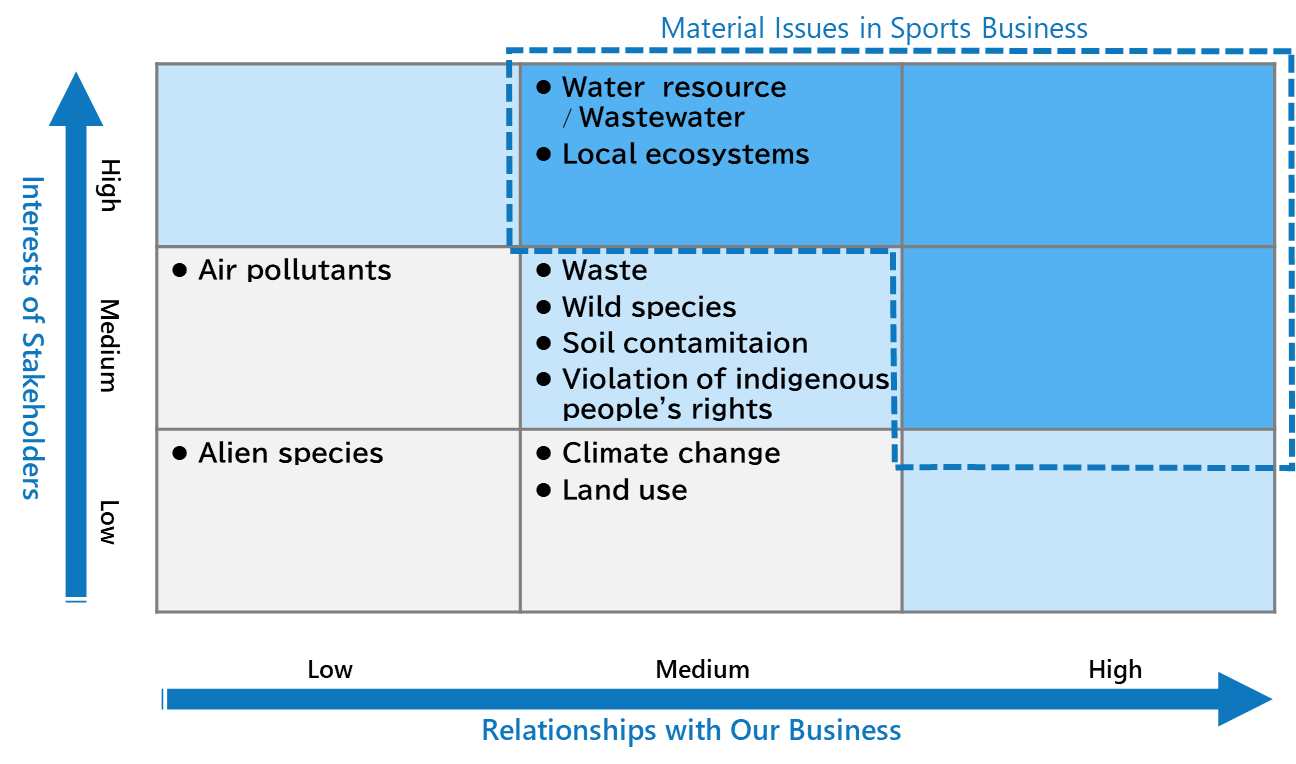

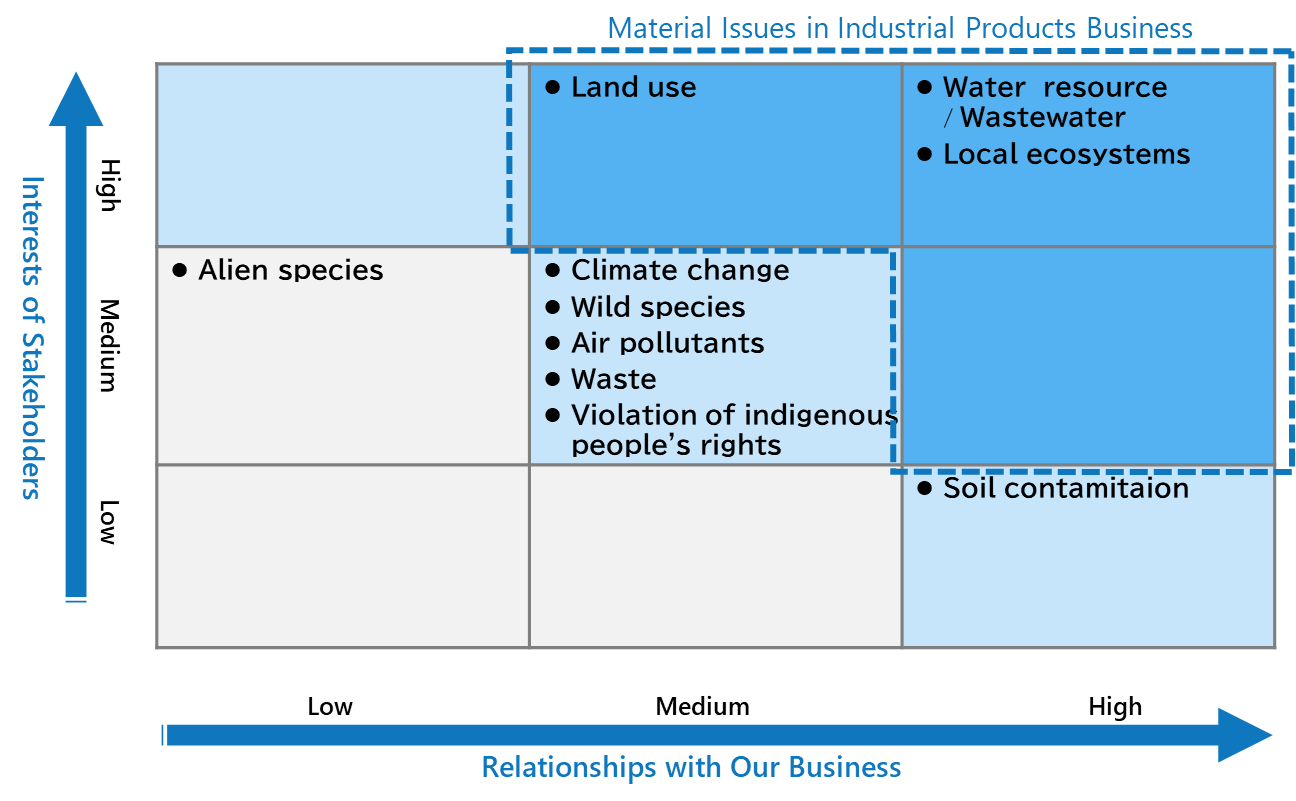

Based on the results of these investigations and analyses, the results of the ENCORE analysis were used as the vertical axis, "Interest of Stakeholders," and the results of the risk severity assessment based on the LEAP approach as the horizontal axis, "Relationship with Our Business," for the below figure, with "infringement of indigenous people's rights" being added as an issue and nature-related risks for our business being organized into a materiality map.

In our tire business, four key nature-related issues were identified: “land use and development (including forests),” “local ecosystems,” “violation of indigenous peoples' rights,” and “water resource and wastewater.”

In our sports business, “water resource and wastewater” and “local ecosystems” were identified as material issues.

In our industrial products business, “water resource and wastewater,” “local ecosystems,” and “land use” were identified as material issues.

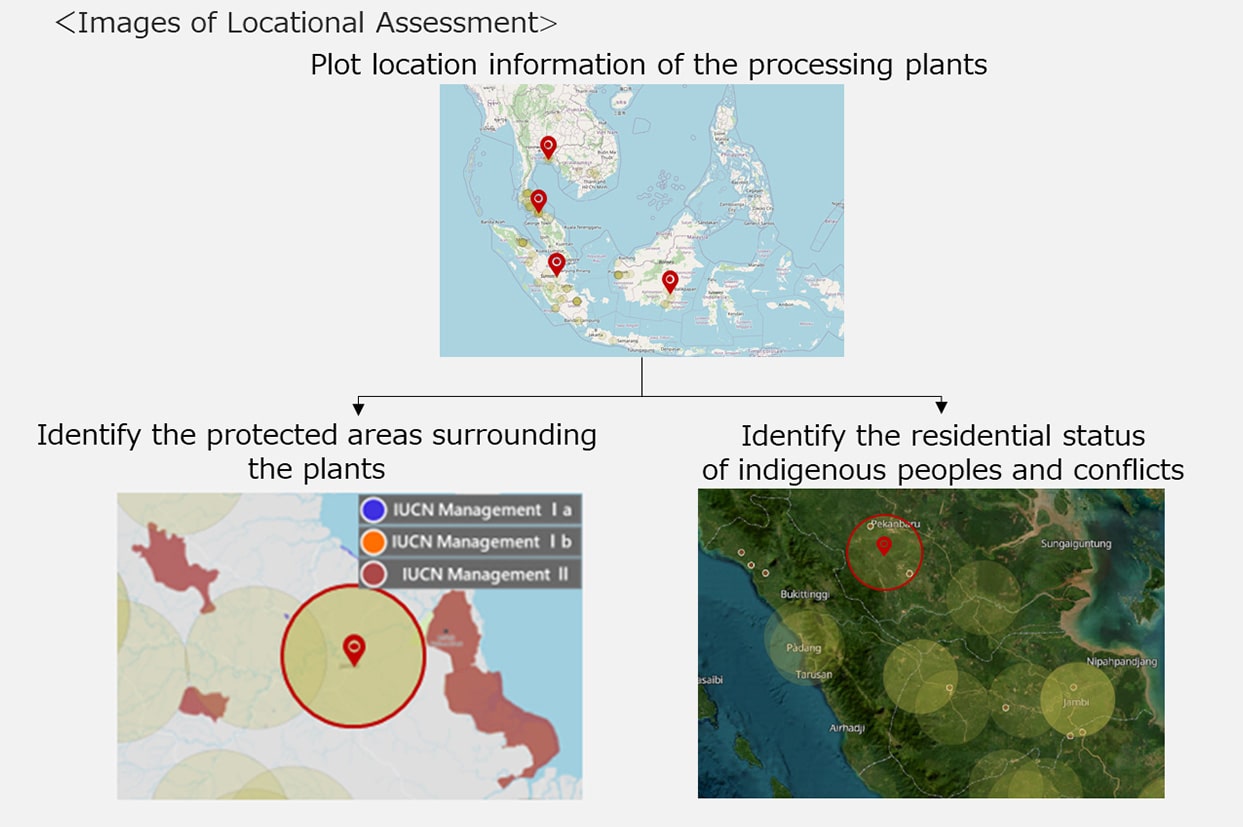

In order to examine measures to address the identified material issues, a locational assessment of the value chain was carried out to delve deeper into the issues.

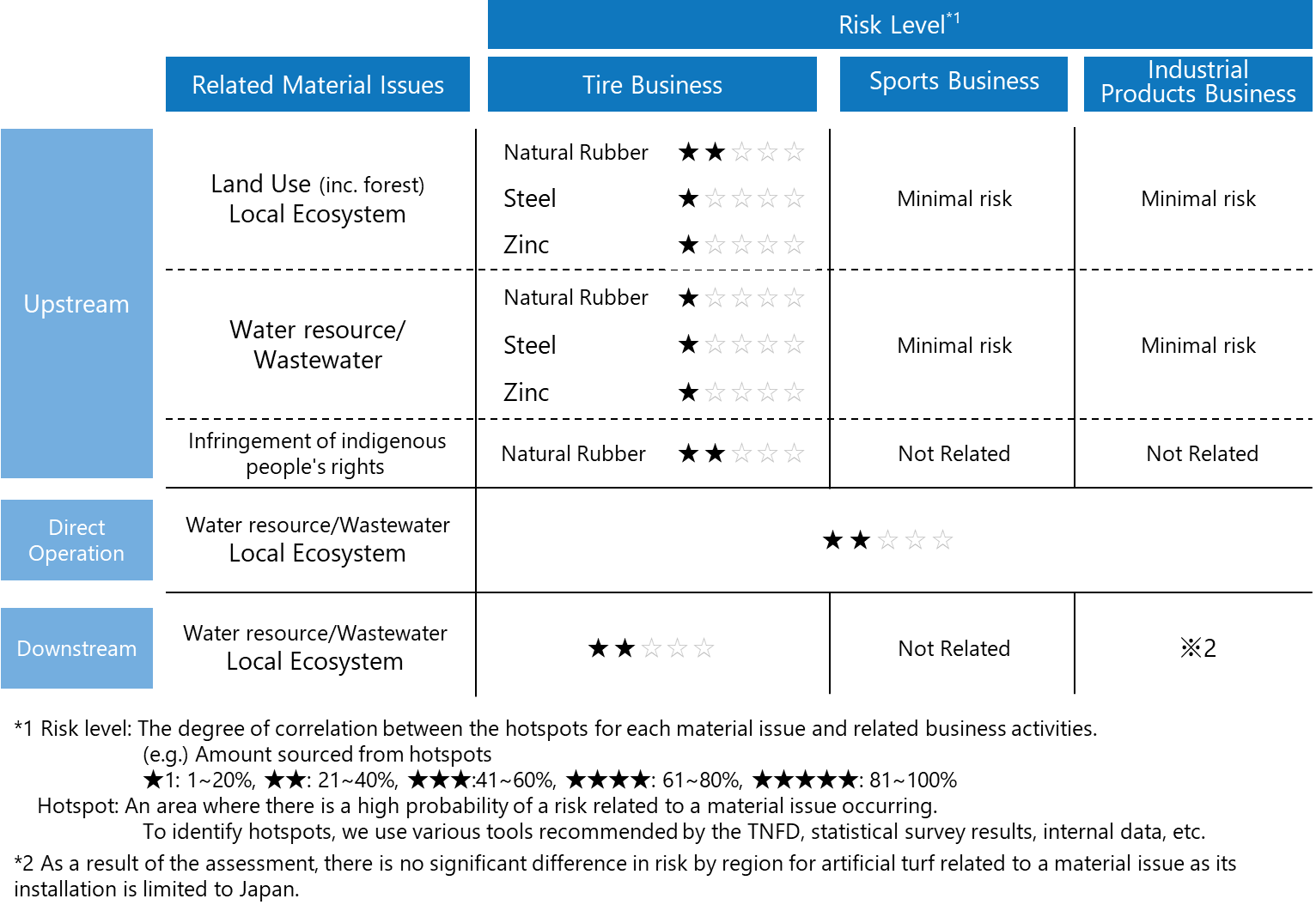

In the locational assessment, the identified material issues were first organized by determining at which stage of the value chain - upstream, direct operations, or downstream - they occur. Then, for the material issues related to each stage of the value chain, hotspots were identified by assessing biodiversity risks in business activities using tools such as IBAT, and their impact on our business was investigated and identified. We will continue to study and promote measures to address the material issues identified through this assessment.

The results of the locational assessment are summarized below.

In countries such as Sri Lanka, Cambodia, Nigeria, and Cameroon, local communities and international NGOs have raised concerns that deforestation to expand rubber plantations could be a potential source of ecosystem degradation. In addition, in relation to the EU's regulations on preventing deforestation, companies will also be required to comply with due diligence and disclosure obligations for traceability. In addition, in countries such as Brazil, Chile, an

When analyzing risks at the raw material procurement stage, we included the commodities* of natural rubber, iron, and zinc in our assessment, as they are particularly closely related to our business and have a significant impact on nature.

For natural rubber procurement, we assessed biodiversity risks using IBAT, a biodiversity risk measurement tool, and identified hotspots based on information about the location of natural rubber processing sites and areas of biodiversity significance.

For iron and zinc procurement, we identified mines with high biodiversity risks in major producing countries as hotspots using IBAT and Global Forest Watch, a tool for visualizing forest change.

*Commodities (raw materials) included in the High Impact Commodity List as defined by SBTN.

The impacts of rubber plantation expansion include not only deforestation but also land exploitation from indigenous peoples. For example, a company establishing rubber plantations in Nigeria will pay compensation to local communities for converting part of a forest reserve into a rubber plantation through illegal trade without due process.

LandMark, a database that integrates the distribution of land ownership and indigenous settlements, was used to confirm the residential status of indigenous peoples in the vicinity of our processing plants. The Environmental Justice Atlas, which can identify social conflicts over environmental issues, was also used to identify hotspots of conflict around our processing plants.

There are also concerns about the impact of extracting water from areas experiencing high water stress where water resources have been depleted and water pollution caused by factory wastewater and leaks of toxic chemicals. In California, where water resources are becoming increasingly scarce, a court order was issued to suspend the water extraction rights of a manufacturer of drinking water on the grounds that the extraction of water from a national forest was harming the local wildlife.

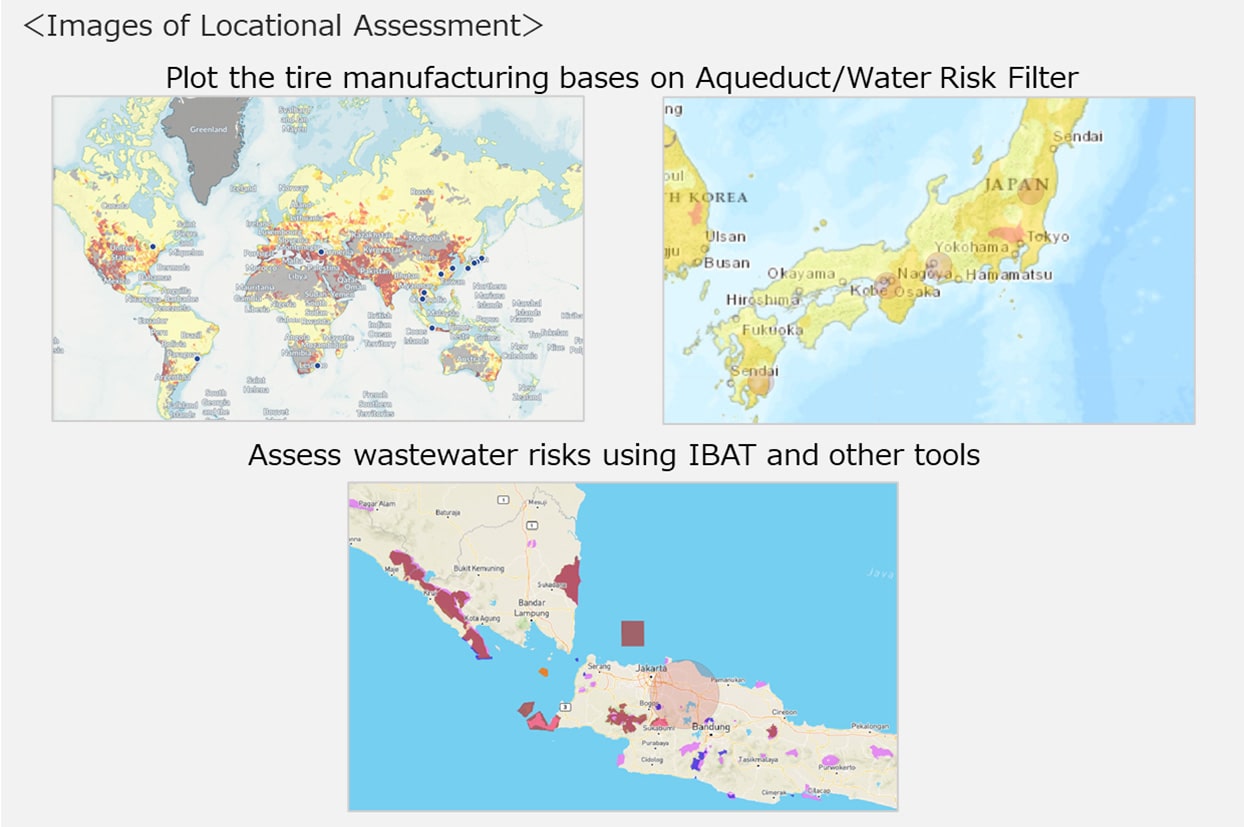

We used Aqueduct and Water Risk Filter, water risk assessment tools, to assess water stress and water quality around our natural rubber processing plants and iron and zinc mines. We also used IBAT to assess the biodiversity risk for wastewater.

Similar to the examples seen in upstream value chains, there are cases where water extraction is restricted by governments and other parties when operating in areas with high water stress.

In assessing the nature-related risks associated with the extraction and discharge of water from our manufacturing sites, we used Aqueduct, Water Risk Filter, and IBAT and identified hotspots for water extraction.

We identified high water risk sites based on their Aqueduct scores, past records on water extraction restrictions and water consumption at each production site in the past few years, and the results of interviews with these sites. Our goal is to achieve a 100% water recycling rate at these sites by 2050.

In recent years, the EU has issued a draft regulation, Euro 7, that sets new EU emission standards for air pollutants from cars, and new regulations will also apply to dust emissions from tire wear. In the US, concerns have been raised about the possible impact on certain species of fish from anti-aging agents used in tires. We also observed that in Europe and the US, regulations are being developed for microplastics and PFAS emitted from artificial turf.

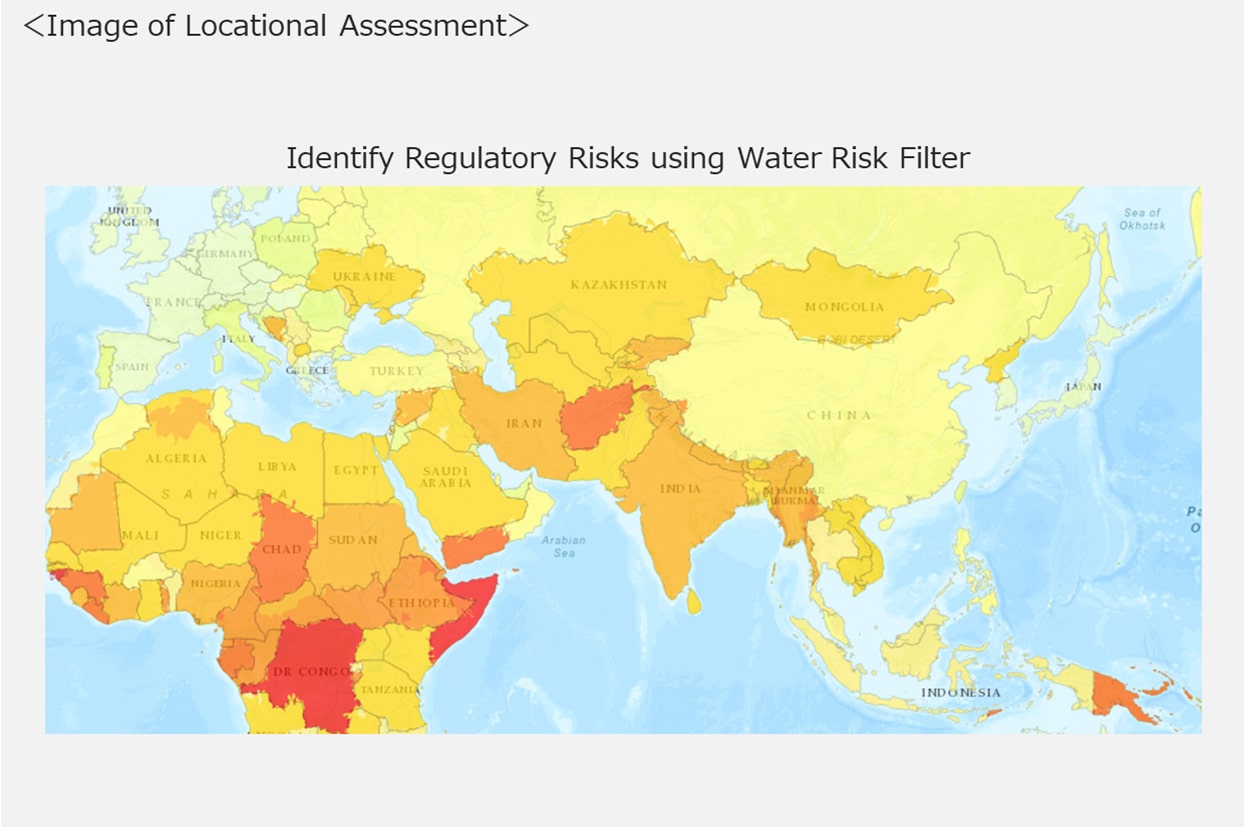

Using Water Risk Filter, a water risk assessment tool, we assessed water-related regulatory risks in the countries where our tires are sold and identified hotspots. Our artificial turf has only been installed in Japan, and we have assessed that there are no significant differences in the nature-related risks at our respective facilities.

The Sumitomo Rubber Group is considering measures to manage the climate and nature-related risks and opportunities to its business and impact to society based on scenario and locational analyses. In making these considerations, we are preparing a variety of initiatives based on the three social issues of “climate change,” “biodiversity,” and “circular economies,” which are materiality for the Group.

We are working on initiatives for our production processes that utilize hydrogen energy and are expanding our transition to power derived from renewables to achieve decarbonization in fuel and power. In January 2023, we started the mass production of tires that had achieved carbon neutrality during their manufacturing (Scope 1 and 2) and were the first in Japan to use hydron energy and solar power*1.

For water usage, the Group identified production sites with high water risk based on their Aqueduct water stress score, past records on water extraction restrictions and water consumption at each site, regulatory risks, and the results of interviews with these sites. For the following seven factories assessed as having high water risk, we are implementing measures to reduce water stress as part of our long-term sustainability policy stipulating that 100% of factory wastewater is to be recycled by 2050. Our Thailand Factory, having been assessed as one of the Group's most water-stressed plants, achieved 100% recycling of its factory wastewater in 2024.

| Location name | Main manufactured items | Location address |

|---|---|---|

| Changshu Factory (China) | Automotive tires | Changshu Economic Development Zone, Jiangsu, China |

| Hunan Factory (China) | Automotive tires | Changsha, Hunan Province, China |

| Thailand Factory | Automotive tires Motorbike tires Agricultural and industrial vehicle tires |

Amata City Rayong Industrial Estate, Rayong Province, Thailand |

| Indonesia Factory | Automotive tires Golf balls Motorbike tires |

Cikampek, Karawang, Indonesia |

| Brazil Factory | Automotive tires | Fazenda Rio Grande, Paraná, Brazil |

| Turkey Factory | Automotive tires | Çankırı, Republic of Turkey |

| South Africa Factory | Automotive tires | KwaZulu-Natal, Republic of South Africa |

In addition, we are working to develop a BCP to minimize any damage in the event of a disaster.

As a part of our procurement phase for tire raw materials, we are attempting to strengthen supplier engagement and are requesting in our procurement guidelines cooperation in achieving carbon neutrality, are holding briefing sessions, and are obtaining primary data in order to reduce Scope 3 Category 1 emissions (emissions for purchased products and services). With regard to the procurement of natural rubber, which has a significant impact on our business in terms of nature-related issues, we joined the GPSNR in September 2018. In November 2018, we formulated the Sumitomo Rubber Group’s “SNR Policy,” which reflects the content of the GPSNR policy framework and was updated in August 2021. Based on this policy, we are actively promoting initiatives in collaboration with stakeholders in the supply chain to achieve sustainable natural rubber sourcing. The Group is also implementing initiatives to ensure traceability in natural rubber procurement. In 2023, we introduced RubberWay®, a software program that enables mapping of the natural rubber supply chain, and we are promoting the development of a sustainable procurement network through risk assessment and reduction activities. We are also working on resolving issues through collaboration with stakeholders, including support for neighboring farmers and joint research with universities.

The Group aims to establish a recycling-oriented business (circular economy) throughout its entire supply chain, focusing on tire products, our core business. We have formulated “TOWANOWA,” our own circular economy concept in our tire business, where we work on reducing the generation of waste through the minimum and more efficient use of resources as well as promoting resource regeneration by expanding reuse and recycling efforts.

In addition, the Sumitomo Rubber Group is looking to future mobility societies and is promoting the development of tires with even higher safety and environmental performance and “SMART TYRE CONCEPT,” a concept that will develop peripheral services.

As part of our efforts to reduce nature-related risks during the product use phase, we conducted a proof-of-concept test to reduce microplastic runoff from sports artificial turf in cooperation with Nishinomiya City in Hyogo Prefecture, which owns and manages a facility where sports artificial turf is used. This was the first publicly announced initiative of its kind in Japan. It has been pointed out that long-pile artificial turf for sports may, over time, result in broken artificial turf and rubber chips flowing out of the field, potentially reaching rivers and harbors and turning into microplastics. Moving forward, we will regularly monitor changes over time and verify the effectiveness of each countermeasure, the suitability and durability of barrier materials, and the need for maintenance. We are committed to developing and promoting the dissemination of runoff control technology.

In addition, we are also developing and installing artificial turf that uses natural material fillers. Using natural material fillers will reduce the proportion of polymer fillers used and will help in curbing the emission of microplastics. “Palmfill,” a natural material filler, is a material with excellent water retention abilities and has, in particular, been shown to be effective in controlling the surface temperature of grass during the summer. In addition, the material itself feels more like natural grass due to having a similar feel to that of dirt and well help in reducing the burden placed on athletes’ bodies.

The Group engages in greening activities and the protection of rare plants and animals at our business sites and in the local communities. In 2024, Shirakawa Plant was certified as a “Sustainably Managed Natural Site” by the Ministry of the Environment of Japan, contributing to the realization of 30by30 (a target to effectively preserve at least 30% of land and sea as healthy ecosystems by 2030).

We will continue to examine and promote measures to address material issues.

From among TCFD’s cross-industry disclosure metrics, Sumitomo Rubber Group is disclosing its GHG emissions and Internal Carbon Pricing (ICP). In addition, from among TNFD’s core disclosure metrics, we are disclosing our GHG emissions, waste emissions, and water usage in our global environment data. For core disclosure metrics that the Group is currently unable to disclose, we are preparing to disclose said metrics by collecting data and conducting even more detailed analysis.

To create a framework for promoting internal activities in order to achieve our carbon neutrality targets, we introduced ICP in 2022. We then officially adopted the ICP approach in 2023. Although we had previously applied ICP only to investments in energy-saving measures, we now implement ICP to examine all investment projects that could possibly affect our volume of CO2 emissions.

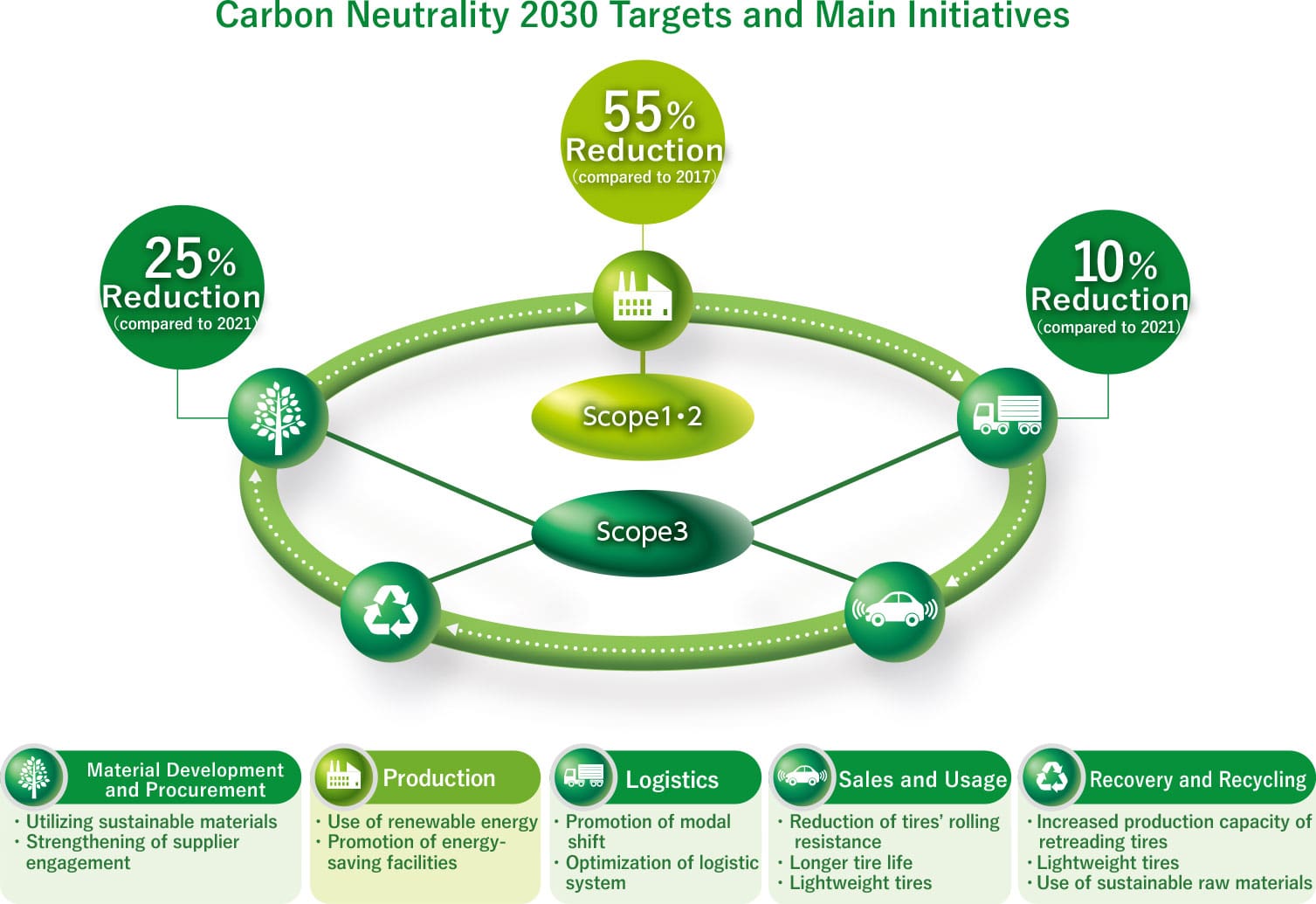

In February 2021, the Sumitomo Rubber Group committed to achieving carbon neutrality (Scope 1 and 2) by the year 2050. In August 2021, we unveiled “Driving Our Future Challenge 2050,” which is our long-term sustainability policy. Based on this policy, we have set long-term targets to be attained by 2050, with one of these being carbon neutrality.

In 2024, the previous goal of reducing Scope 1 and Scope 2 emissions by 50% compared to 2017 was increased to 55%, and we obtained SBT certification along with our Scope 3 Category 1 reduction targets. The reason for increasing this goal was due to the steady progress each production site had made on their measures to reduce emissions, indicating that decarbonization efforts throughout the Group are making steady progress.

To achieve these targets, we are working to reduce energy consumption while expanding cogeneration and the use of solar power. Furthermore, we have begun using hydrogen, which is being hailed as a next-generation energy source, in our manufacturing processes for mass-producing tires, having completed verification testing for its utilization. At the same time, we are advancing and expanding the technologies that we developed to create fossil resource-free tires so that we may increase the biomass and recycled content of our products as another means of contributing to the realization of carbon neutrality.

The Sumitomo Rubber Group aims to achieve 100% sustainable raw materials (biomass and/or recycled raw materials) by 2050. We also aim to achieve 100% recycling of factory wastewater by 2050 at our direct operations sites with high water risks. In the future, we will consider setting metrics and targets in line with the TNFD Recommendations.

| 2030 | 2050 | ||

|---|---|---|---|

| Tire Business | Tires | 40% | 100% |

| Sports Business | Golf balls | 20% of all practice golf balls sold | 100% of all golf balls sold |

| Tennis balls | Launch of 100% sustainable tennis balls | 100% of all tennis balls sold | |

| Industrial Products Business | All Products (% of gross weight) | 40% | 100% |